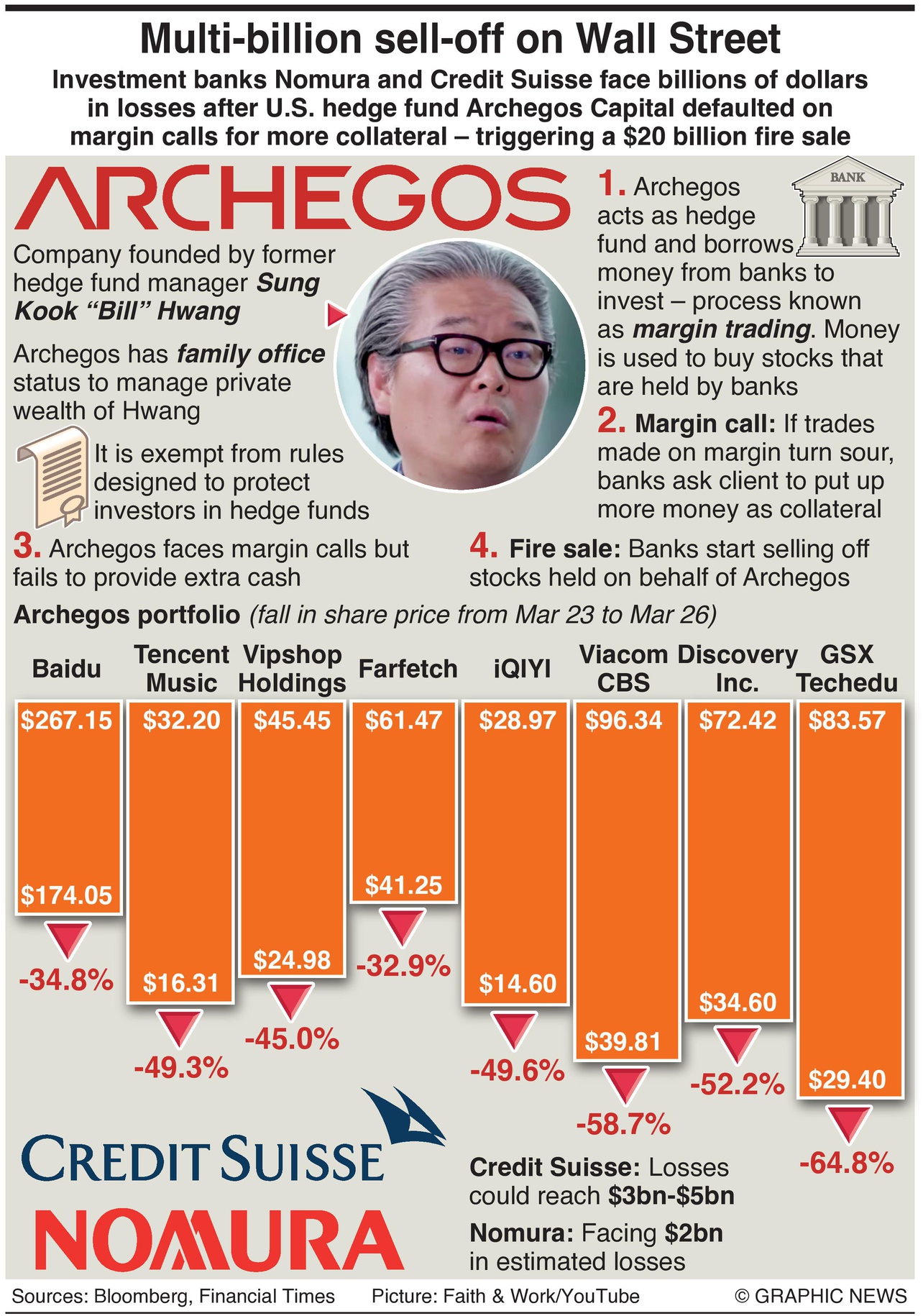

March 30, 2021 – Investment banks Nomura and Credit Suisse face billions of dollars in losses after U.S. hedge fund Archegos Capital defaulted on margin calls for more collateral — triggering a $20 billion fire sale.

Late last week, Wall Street saw the prices of several big-name media stocks, most notably Viacom CBS and Discovery and Chinese tech stocks, including the internet search giant Baidu and Tencent Music Entertainment were plunging.

The falls were stunning. Between Tuesday and Friday last week, Baidu fell by 34.8%, from a high of $267.15 to a low of $174.05. Tencent Music Entertainment by 49.3%, while in New York, shares of Discovery and Viacom CBS — owner of MTV and Nickelodeon — more than halved in value, by 52.2% and 58.7%, respectively.

Investors speculated that an unnamed hedge fund had defaulted on a sizeable “margin call”. In other words, one of the fund’s lenders had demanded more collateral against losing trades.

Archegos Capital was the forced seller — a relatively little-known “family office” running the wealth of an investor called Sung Kook “Bill” Hwang.

In 2012, Hwang closed Tiger Asia Management and Tiger Asia Partners hedge funds after settling a U.S. Securities and Exchange Commission civil lawsuit accusing them of insider trading and manipulating Chinese banks stocks. Hwang and the firms paid $44 million, and he agreed to stop running hedge funds.

On Monday (March 29), banks including Credit Suisse and Nomura warned investors and regulators that they faced billions of dollars in losses from their dealings with Archegos.

Nomura warned that it is facing $2bn in estimated losses, and Credit Suisse then said that its potential losses could be “highly significant and material to our first-quarter results”. The Financial Times suggests that the eventual figure could reach $3bn-$5bn.